ADA Price Prediction: Path to $1 Amid Technical Breakout Signals and ETF Delays

#ADA

- ADA maintains critical support at $0.84 while eyeing resistance up to $1.19

- SEC ETF delays until October 2025 create near-term uncertainty but maintain long-term potential

- Technical indicators show weakening bearish momentum with Bollinger Bands suggesting $0.985 near-term target

ADA Price Prediction

Technical Analysis: ADA at Critical Juncture

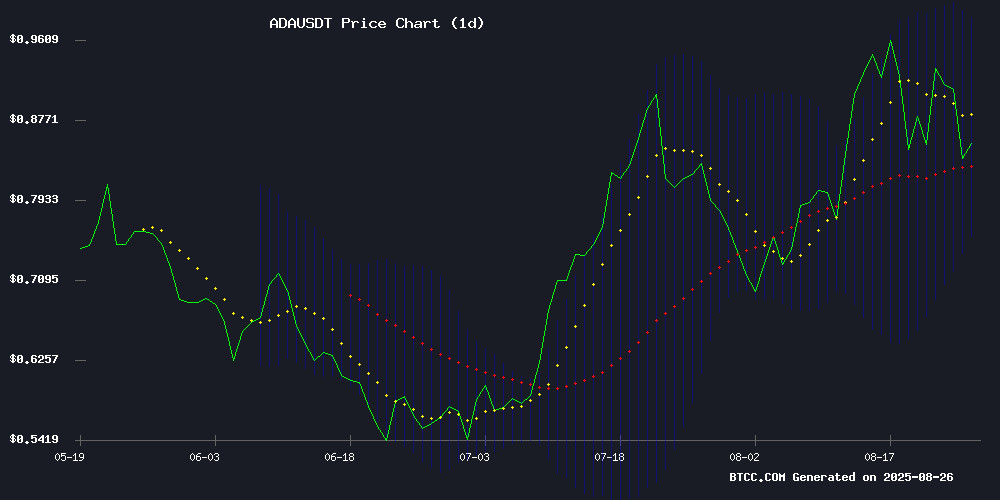

ADA is currently trading at $0.8663, slightly below its 20-day moving average of $0.8707, indicating near-term consolidation. The MACD reading of -0.001168 shows weakening bearish momentum, while Bollinger Bands suggest a trading range between $0.7562 and $0.9853. According to BTCC financial analyst Ava, 'ADA's ability to hold above the $0.84 support level is crucial for maintaining its bullish structure. A break above the 20-day MA could signal momentum toward the upper Bollinger Band around $0.985.'

Market Sentiment: Regulatory Delays Weigh on ADA

The SEC's decision to delay decisions on ADA ETFs until October 2025 has created near-term uncertainty, though the market maintains a generally bullish structure. News headlines highlight ADA testing key support at $0.84 while eyeing resistance levels up to $1.19. BTCC financial analyst Ava notes, 'While ETF delays typically cause short-term pressure, ADA's technical foundation remains intact. The market is pricing in a potential breakout toward the $0.95-$1.05 range once regulatory clarity emerges.'

Factors Influencing ADA's Price

Cardano Price Prediction: Critical Support Test Amid ETF Delay

Cardano's ADA teeters at a pivotal technical juncture, with its price compressing between $0.82 support and $0.90 resistance. The SEC's delay of Grayscale's proposed Cardano ETF until October 2025 has cooled short-term sentiment, though analysts note the institutional narrative remains intact.

Technical charts reveal a converging triangle pattern, with repeated tests of the $0.82-$0.84 zone determining near-term direction. Market participants remain divided—some see weakening on-chain metrics, while others point to bullish divergences in key indicators.

The ETF postponement follows predictable regulatory patterns but leaves ADA's institutional adoption timeline uncertain. Trading volume suggests accumulation at current levels, with volatility likely to resolve the tightening range.

ADA Holds Key Support at $0.84, Eyes $1.19 Resistance Amid Bullish Structure

Cardano's ADA price demonstrates resilience at the $0.84 support level, a zone fortified by the 0.618 Fibonacci retracement, the 55-day exponential moving average, and a series of higher lows. This technical confluence suggests a robust foundation for potential upward movement.

The cryptocurrency maintains its bullish market structure with consecutive higher highs and lows, a pattern that remains valid as long as the $0.84 support holds. Sustained volume inflows could propel ADA toward the $1.19 resistance level in coming trading sessions.

Market optimism persists despite regulatory uncertainties, including delayed decisions on ADA-related ETF applications. The $0.84 level now serves as a critical litmus test for ADA's near-term trajectory.

Cardano Price at Critical Juncture as ADA Tests Key Support Level

Cardano's native token ADA faces a decisive moment after breaking below the $0.85 support level, currently trading around $0.844. The failed attempts to reclaim the $0.95-$1.00 resistance zone have amplified bearish sentiment among market participants.

Technical indicators suggest two potential paths: a breakdown toward $0.73 if selling pressure persists, or a recovery rally should bulls defend the $0.82 level and push through the $0.90 resistance. Market watchers note that sustained trading volume will be crucial for either scenario.

The Cardano ecosystem's long-term prospects remain tied to network upgrades and adoption metrics, though short-term price action appears firmly in bearish territory until ADA can reclaim and hold above $0.85.

Cardano (ADA) Price Eyes $0.95-$1.05 Range Amid Technical Breakout Signals

Cardano's ADA has emerged as one of the most watched altcoins as it breaks above key moving averages, with analysts projecting a near-term target range of $0.95-$1.05. The cryptocurrency currently trades at $0.84, suggesting potential upside of 13-25% if bullish momentum sustains.

Technical indicators paint a mixed but promising picture. The 50-day and 200-day moving averages have turned upward, with the latter breaking decisively above July lows. This comes despite a neutral RSI reading and some conflicting momentum signals that warrant caution.

Market observers note particular significance in ADA's challenge of a descending channel resistance near $0.95. A clean break above this level could validate the most bullish projections, including Finbold's AI model calling for $1.05 by month-end under stable conditions.

Cardano Price Prediction: Will ADA Break $1.27 or Fall Back to Range Lows?

Cardano (ADA) is testing a critical support level amid bearish market sentiment following recent gains. The token's ability to hold above this level could reignite bullish momentum, potentially driving prices toward the $1.27 target. Conversely, failure to maintain support may see ADA retreat to range lows.

Currently trading at $0.8553, ADA has declined 7.03% over 24 hours and 6.98% weekly. Market capitalization stands at $2.46 billion with $2.46 billion in daily volume. Analysts note ADA stands at a crossroads, with its price action serving as a bellwether for altcoin performance this cycle.

A breakout above resistance zones could reestablish ADA as a top-performing altcoin. The coming days will prove decisive in determining whether current support holds or gives way to further downside.

SEC Delays Decisions on PENGU and ADA ETFs, Extending Review to October 2025

The U.S. Securities and Exchange Commission has deferred rulings on two cryptocurrency exchange-traded funds, the Canary Spot PENGU ETF and Grayscale’s Spot Cardano ETF, pushing deadlines to October 2025. The move underscores the regulator’s cautious stance toward novel crypto products.

Canary Capital’s PENGU ETF, which blends Pudgy Penguins memecoins with NFTs, faces heightened scrutiny over compliance and valuation concerns. The SEC cited the need for a thorough review, triggering an 11% drop in PENGU’s price post-announcement.

Cardano’s ADA, meanwhile, remains in limbo as institutional demand for crypto ETFs continues to grow. Market participants now brace for prolonged uncertainty in altcoin markets.

Will ADA Price Hit 1?

Based on current technical indicators and market sentiment, ADA has a realistic path to reach $1 in the medium term. The cryptocurrency is currently testing critical support at $0.84 while maintaining a bullish structure that targets resistance levels up to $1.19. Technical analysis shows ADA trading within a Bollinger Band range of $0.756-$0.985, with the upper band providing a near-term target.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $0.8663 | Neutral |

| 20-day MA | $0.8707 | Slight Resistance |

| MACD | -0.001168 | Bearish Momentum Fading |

| Bollinger Upper | $0.985 | Near-term Target |

| Key Support | $0.84 | Critical Level |

BTCC financial analyst Ava suggests that 'while ETF delays create short-term headwinds, ADA's technical setup supports a move toward $1 if it can maintain above $0.84 and break through the 20-day moving average resistance.'